Banks and Other Financial Institutions Engage in Financial Intermediation Which

Total global financial assets exhibited strong growth in 2020 increasing by 109 to 4687 trillion. So it is crucial to understand what EMI Institutions.

Identified Indices Of Financial Intermediation For Banks In The Data Sample Download Scientific Diagram

Microfinance is a category of financial services targeting individuals and small businesses who lack access to conventional banking and related services.

. These broad definitions together with the fact that statistics are available for only a part of the business and only for some OFCs have shaped the coverage of OFCs by international financial institutions and commentators ranging from the 14 OFCs listed in the joint BIS-IMF-OECD-World Bank statistics on external debt to the 69 OFCs listed in Errico and. A foreign financial institution includes among others. Top 100 Financial Advisors in the Nation 2004 2022 including the Number 1 Advisor at Merrill from 2009 2022.

This course studies financial institutions and focuses on the stability of the financial system. Finance and Technology Specialisation. Accounting firms investigate businesses in order to make sure that their accounts annual reports offer an accurate reflection of the financial situation.

Gara Afonso Lorie Logan Antoine Martin William Riordan and Patricia Zobel. Financial Instruments Business Operators that conduct Type I Financial Instruments Business are subject to strict property regulation including Capital Adequacy Ratio Article 29-41via and Article 46-62 of the FIEA as well as stock company requirement major shareholder regulation and subsidiary business regulation Article 29-41iv through v Articles 32. A shadow banking system refers to the financial intermediaries involved in facilitating the creation of credit across the global financial system but whose members are not.

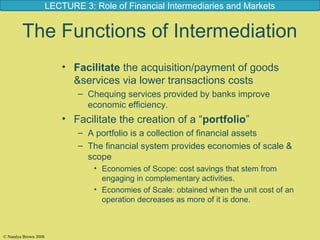

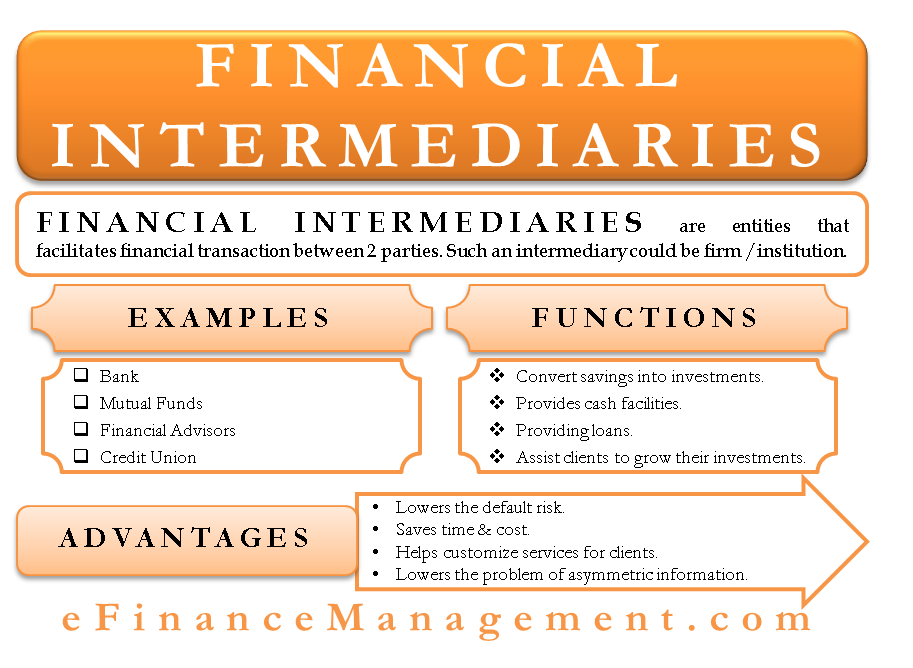

I a foreign bank including a foreign branch or office of a US. Banks and in some instances to certain other financial or public institutions. Financial intermediaries function basically by connecting an entity with a surplus fund to a deficit fund.

This was faster than the global NBFI sector comprising mainly pension funds insurance corporations and other financial intermediaries OFIs1 which experienced asset growth of 79 reaching 2266 trillionThe faster growth in bank central bank and public. For this purpose the Cardholder andor Supplementary do hereby consent and authorize said bank or financial institution to disclose to BPI or its duly authorized representative any information relative to any depositplacement the Cardholder andor Supplementary may have with any such banks or financial institutions. An important example concerns accounting auditing firms.

After all when I have an established relationship with a software offering theres less of a need for the payment intermediation offered by the credit card rails. Top Advisor Rankings State-by-State 2009 2022. This was around 2000 BCE in Assyria India and SumeriaLater in ancient Greece and during the Roman Empire lenders based in temples gave loans while accepting deposits and performing the change of.

In the second post in this series we take a closer look at this important tool in the Federal Reserves monetary policy. By contrast physical central bank money ie cash is widely accessible. Savings and checking accounts.

Microfinance includes microcredit the provision of small loans to poor clients. Such institutions are best known for e-money disbursement and payment intermediation which contribute to the total value of digital payments around 6752388 in 2021 and is expected to hit 10715390 by 2025. You will also need to have in-depth knowledge of institutions and regulations.

If you are looking to start your career in the financial intermediation sector in the areas of banking investment banking insurance and asset management both of the above skill sets are required. Modern Treasury has built a platform to complement banks existing products to help them prepare for a future led by software. While there is no clear-cut theoretical framework underlying the distinction between financial data inclusion and financial inclusion the idea underlying the differentiation of financial data inclusion and financial inclusion in Fig.

Already technological regulatory and competitive forces are moving markets toward easier and safer financial data sharingOpen-data initiatives are springing up globally including the United Kingdoms Open Banking Implementation Entity the European Unions second payment services directive Australias new consumer protection laws Brazils drafting of open. Financial intermediation or in auxiliary financial activities that are closely related to financial interme-diation but are not classified as deposit takers6 Their importance within a financial system varies by coun-try. Modern Treasury Can Help.

Shadow Banking System. Ii a foreign branch or office of a securities broker-dealer futures commission merchant introducing broker in commodities or mutual fund. August 05 2022.

The bank said it was fully aware of how grants and cheap funds could help in the financial intermediation efforts and rural financial inclusion agenda of the country. Epistemic virtue is not only relevant for financial agents themselves but also for other institutions in the financial system. Wholesale CBDCs combined with the.

And payment systems among other services. The history of banking began with the first prototype banks that is the merchants of the world who gave grain loans to farmers and traders who carried goods between cities. Top 400 Financial Advisors 2017.

Read more in the economy and support economic. Microfinance services are designed to reach. This approach has in general served the public and the financial system well setting a high bar for changing the current monetary and financial structure.

It covers important theoretical concepts and recent developments in financial intermediation asset pricing under asymmetric information behavioral finance and market microstructure. The Primary Government Securities Dealers Reports Form FR 2004 collect information at a weekly frequency on positions cumulative transactions financing and fails of. An electronic money institution EMI is a symbol of the evolution of financial services.

Role of Financial Intermediary. Daily take-up at the overnight reverse repo ON RRP facility increased from less than 1 billion in early March 2021 to just under 2 trillion on December 31 2021. Figure 1 shows the important role that the government FinTech and banks play in financial inclusion and poverty reduction.

He reckoned that one of the major challenges facing the RCB sub-sector was the low liquidity and the lack of competitively priced loans for on-lending to member banks. They ease the money flow Money Flow Money flow MF refers to a mathematical function used to analyze changes in the value of a security by multiplying its typical price by daily trading volume. Iii a business organized under foreign law other than a branch or office of such business in the.

Other financial corporations include insurance corporations pension funds other financial interme-diaries and financial. Sebastian Infante Lubomir Petrasek Zack Saravay Mary Tian 1. Insights from revised Form FR2004 into primary dealer securities financing and MBS activity.

The Role Of Financial Intermediaries And Financial Market By Badhon

Financial Intermediaries Meaning Functions And Importance Efm

The Daily Non Bank Financial Intermediation 2007 To 2019

The Role Of Financial Intermediaries And Financial Market By Badhon

No comments for "Banks and Other Financial Institutions Engage in Financial Intermediation Which"

Post a Comment